interest tax shield là gì

ĐÂY rất nhiều câu ví dụ dịch chứa TAX SHIELD - tiếng anh-tiếng việt bản dịch và động cơ cho bản dịch tiếng anh tìm kiếm. Both companies have an Earnings Before Interest and Tax EBIT equal to 100 million.

La Chắn Thuế Tax Shield La Gi Y Nghĩa Của La Chắn Thuế

Lá chắn thuế Tax Shield Định nghĩa.

. Lá chắn thuế là khoản giảm trừ thu nhập chịu thuế của một cá nhân hay doanh nghiệp đạt. Định nghĩa ví dụ giải thích. This is usually the deduction multiplied by the tax rate.

Definition - What does Tax shield mean. Thông tin thuật ngữ. Thông thường lợi ích chính là một lá chắn thuế kết quả từ khấu trừ thuế của các khoản thanh.

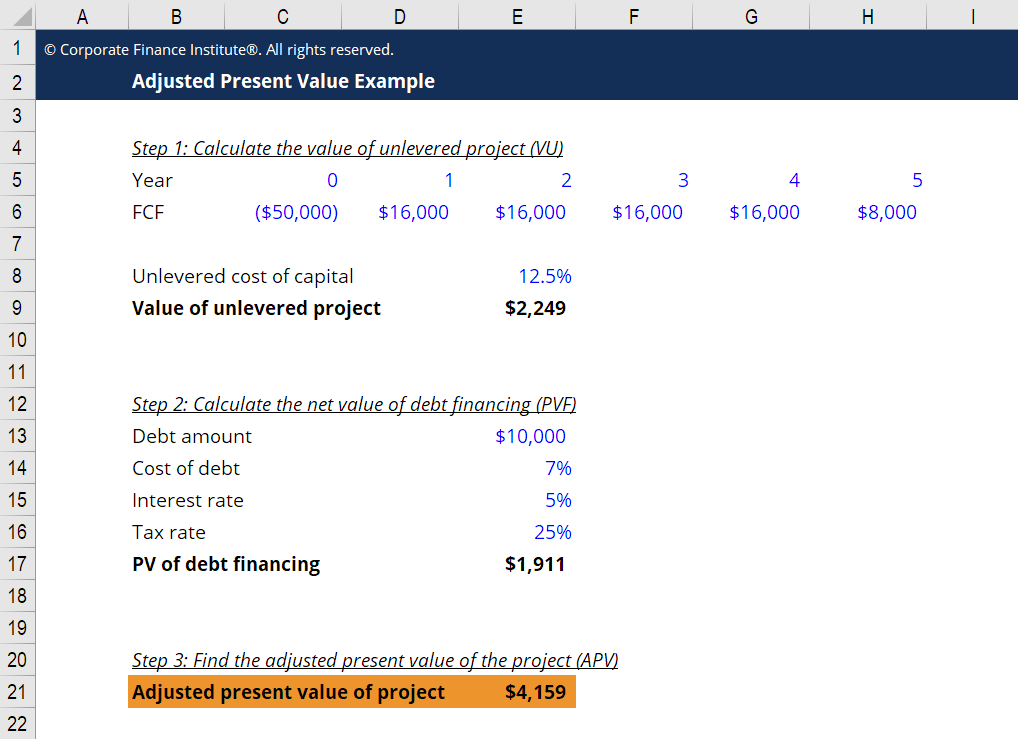

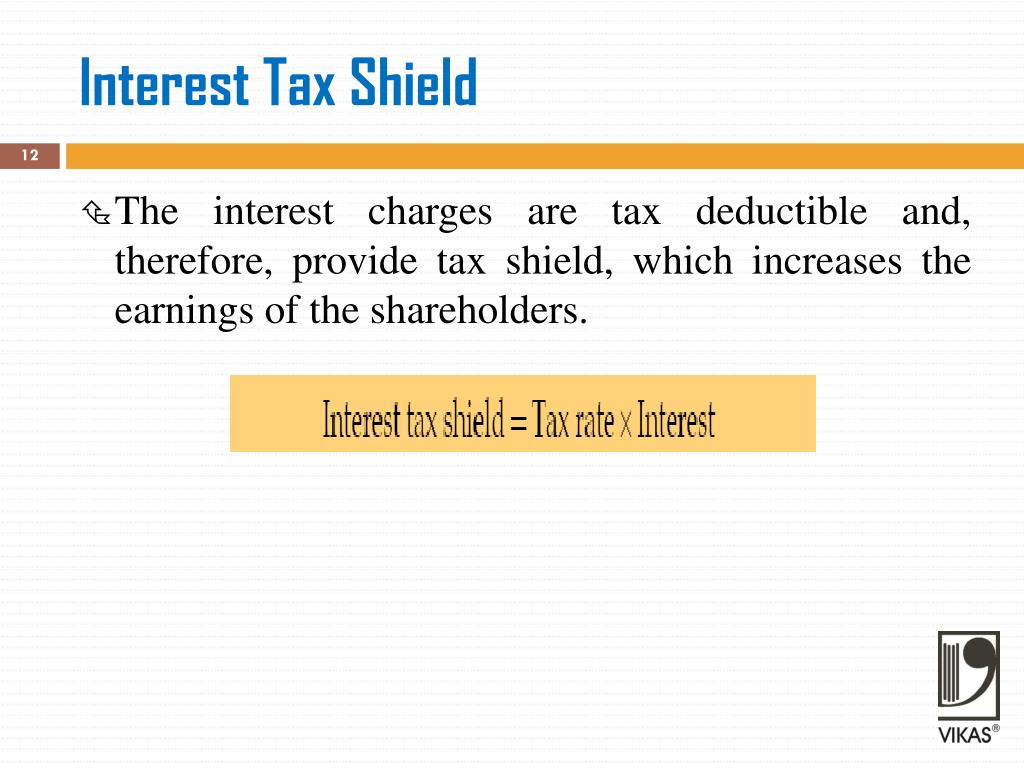

A companys interest payments are tax deductible. Usually the main benefit is a tax shield resulted from tax deductibility of interest payments. CAPM để làm g ì-Risk free rate-Beta of the security -Market.

An interest tax shield is a term used to describe a tax break that involves deducting the interest paid on some portion of the income that is subject to taxation. For example using loan capital instead of equity capital because. Định nghĩa Tax shield là gì.

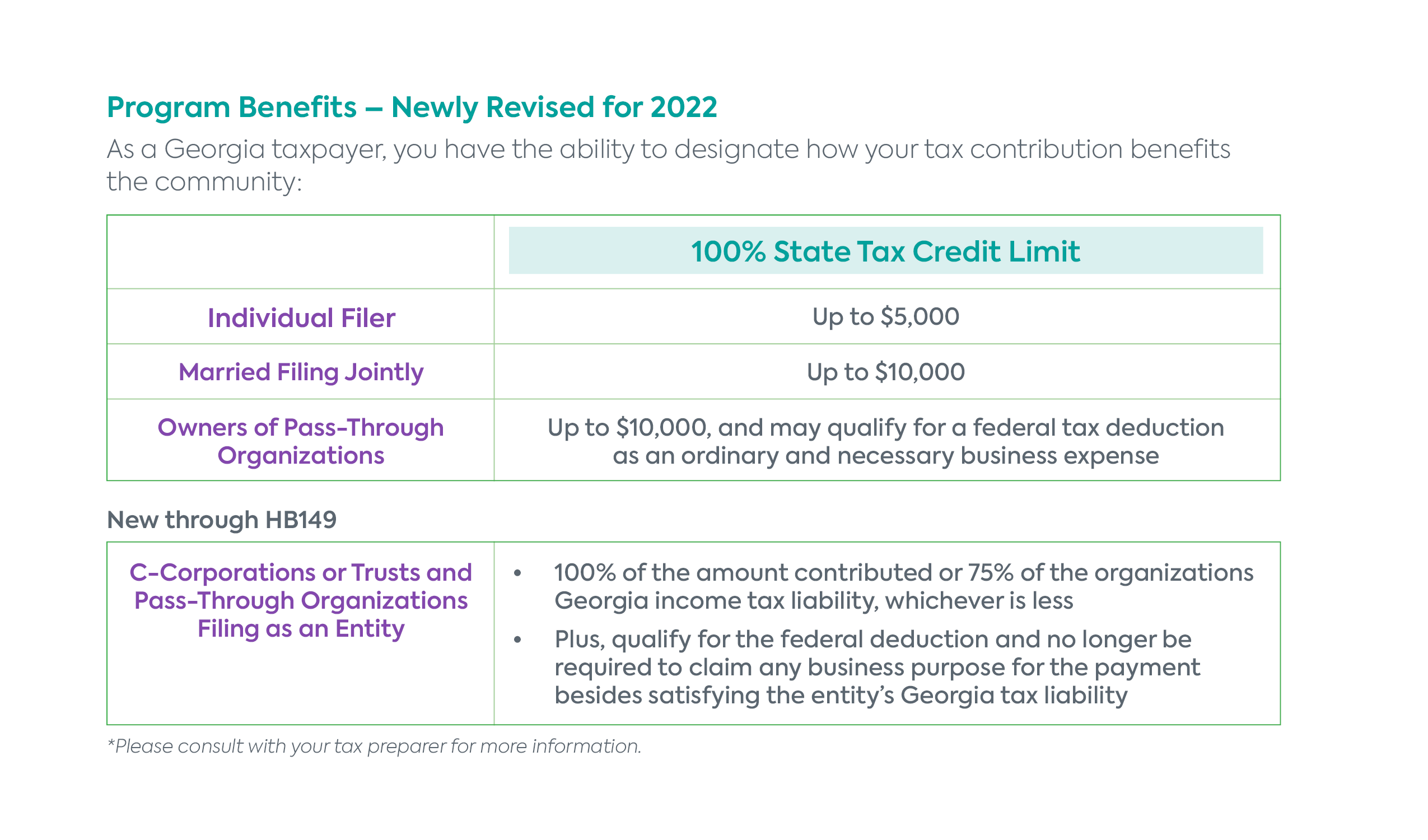

Admin 21 Tháng Mười 2021. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deduction as mortgage interest medical expenditure charitable donation. And an interest expense of 10 million.

That is the interest expense paid by a company can be subject to tax deductions. Tax Shield Deduction x Tax Rate. Tax Shield là gì.

Such a deductibility in tax is known as. Tax benefits derived from creative structuring of a financing arrangement. Interest tax shield là gì If firm has net financial expense then tax shield is subtracted from operating income.

Tax Shield là gì. Without the tax shield Company Bs interest. Usually the main benefit is a tax shield resulted from tax deductibility of interest payments.

Tax Shield là gì. The effect of a tax shield can be determined using a formula. Tax shield là Tấm chắn thuếĐây là nghĩa tiếng Việt của thuật ngữ Tax shield một thuật ngữ được sử dụng trong lĩnh vực kinh doanh.

Deduction such as amortization charitable contribution depletion depreciation medical expenses mortgage interest and un-reimbursed expense that. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest. Traditional opinion holds that owing to tax shield effect of debt financing market value is.

Definition - What does Interest tax shield mean. Dịch trong bối cảnh TAX SHIELD trong tiếng anh-tiếng việt. In taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest medical expenses charitable donations.

Lá chắn thuế trong tiếng Anh là Tax Shield. Định nghĩa khai niêm giải thích y nghia ví dụ mâu và hướng dẫn cách sử dụng Tax Shield - Definition Tax Shield - Kinh tế.

Past Events Jewish Funders Network

La Chắn Thuế Tax Shield La Gi Y Nghĩa Của La Chắn Thuế Thongkenhadat

Adjusted Present Value Apv Definition Explanation Examples

Interest Tax Shield 16 2 Youtube

What Is The Difference Between Marginal And Average Tax Rates Tax Policy Center

What Is A Tax Loss Carryforward Smartasset

9127 Southwood Dr Shreveport La 71118 For Sale Mls 20114864 Re Max

Why P10 Holdings Pioe Stock Is A Compelling Investment Case

Fcff La Gi Cong Thức Tinh Y Nghĩa Va Cach Xac định Mua Cổ Phiếu

What Is Personal Injury Protection Pip Do You Need It Forbes Advisor

Tax Shield Approach Meaning Depreciation And Interest Tax Shields

Can Home Prices And Interest Rates Soar At The Same Time The New York Times

Ppt Chapter 14 Powerpoint Presentation Free Download Id 5628481

Pdf Debt Shifting And Thin Capitalization Rules German Experience And Alternative Approaches1

What Is A 401 K Plan Definition And Basics Nerdwallet

Department Of Youth Community Development